-

SET THE CONTEXT

-

MARKET ANALYSIS AND BUSINESS POSITIONING

-

DEVELOP YOUR SALES FORECAST

-

DEVELOP YOUR OPERATIONAL AND COST PLAN

-

DEVELOP YOUR CASH FLOW PROJECTIONS

-

DETERMINE YOUR FINANCING STRATEGY

-

INTERPRETING THE INCOME STATEMENT

-

INTERPRETING THE BALANCE SHEET

-

INTERPRETING THE CASH FLOW STATEMENT

-

CONCLUSION

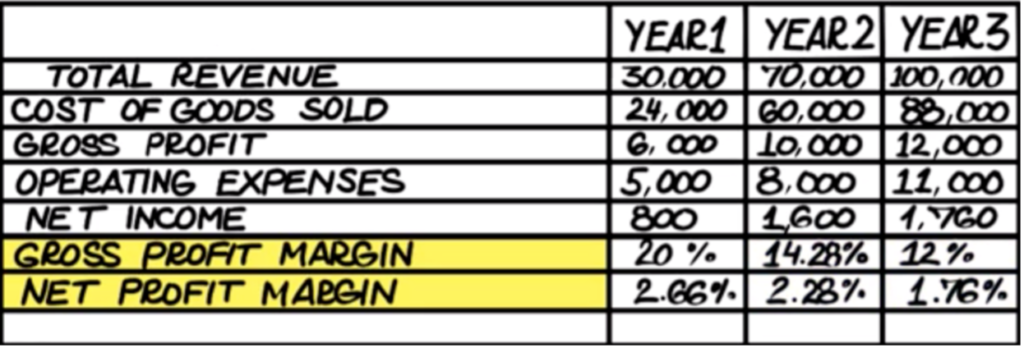

How to analyze an income statement

- Examine the relationship between items in the income statement and total revenue e.g.

- COGS/Total revenue: If high, check if materials are too expensive or productivity is too low

- Compare ratios with a similar company or industry averages to determine your capacity

- Low gross profit margin = inadequate sales, high materials or inventory cost

- Low operating profit margin = operating expenses out of control

- Low net profit margin = high cost of investment or financing activities

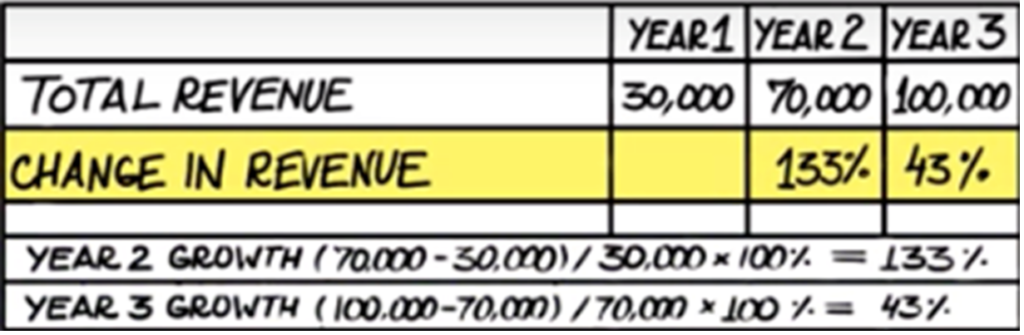

- Trend analysis over time

- Compare over 3 years

- Ratio analysis over time

- Compare over 3 years

To improve profitability:

- Review pricing to be sure you’ve built in adequate margin for profit

- Implement marketing and sales activities to attract customers

- Increase efficiency of production

- Review inventory to detect inefficiencies

- Control operating expenses