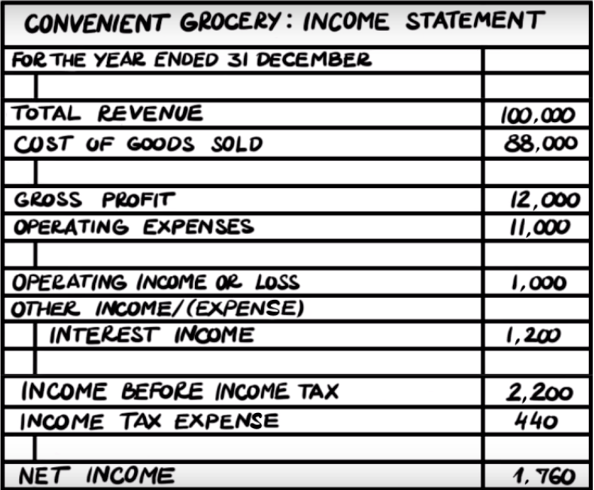

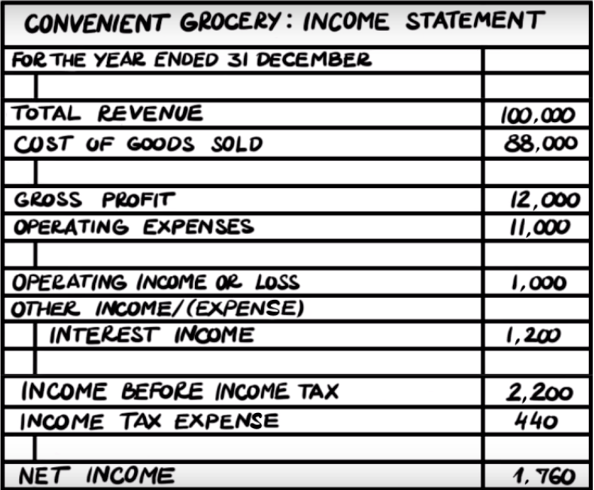

Business Growth Accelerator

How to read an income statement

- Total revenue: Money brought in from sales of goods and services

- Cost of goods sold: Amount of money spent to buy or create products sold

- Gross profit = Total revenue – Cost of goods sold

- Operating expenses: salaries, marketing, rent – can’t be linked directly to the production of goods and services

- Operating income: Money from core operations

- Other income/expenses: Interest from savings accounts, interest on loans

- Net income = Income before tax – income tax

- Net income is known as the bottom line