-

SET THE CONTEXT

-

MARKET ANALYSIS AND BUSINESS POSITIONING

-

DEVELOP YOUR SALES FORECAST

-

DEVELOP YOUR OPERATIONAL AND COST PLAN

-

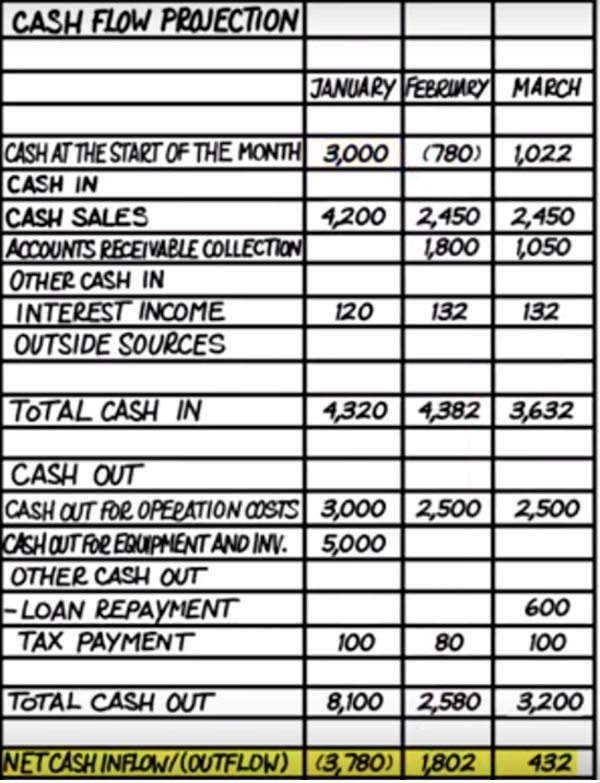

DEVELOP YOUR CASH FLOW PROJECTIONS

-

DETERMINE YOUR FINANCING STRATEGY

-

INTERPRETING THE INCOME STATEMENT

-

INTERPRETING THE BALANCE SHEET

-

INTERPRETING THE CASH FLOW STATEMENT

-

CONCLUSION

How to Create a Cash Flow Projection

Cash flow projections are usually divided into months:

- How much cash comes in each month?

- How much cash will go out?

Cash projections usually have two components: Cash in and Cash out

- Use sales forecast to project cash in

- Include payment from accounts receivables

- Examine past records

- Include cash from outside sources

- Loans

- Interest on savings

- Interest on investment

- Owner’s capital contribution

- The majority of cash going out of your business funds operations: making products or providing services and overhead expenses

- Use operational and cost plan

- Pay attention to payments in advance and accrued payments

- Others include:

- Cash for new equipment or other investments

- Loan repayments

- Tax payments

- Owner’s withdrawals

- Include production costs:

- Paper

- Ink

- Salary

- Employee insurance

- Include overhead:

- Admin staff salaries, delivery, packaging, stationery, telephone and Internet, license fee, interest expenses, utilities, rent

The final output should be your cash flow projection: